Casual Tips About How To Lower Finance Charges On Credit Cards

Alternatively, you could save money on your credit card bills by consolidating most of your debts onto another card with a lower interest rate.

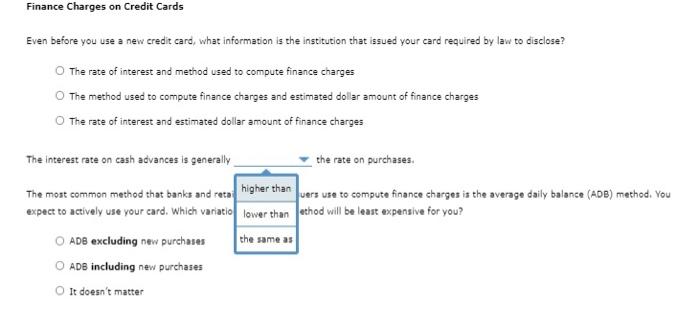

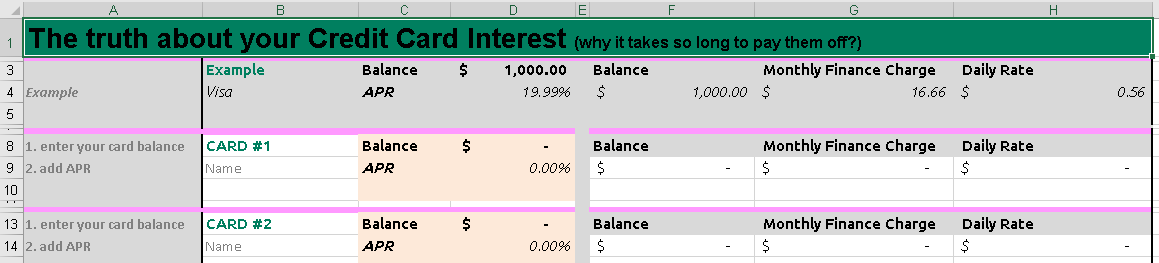

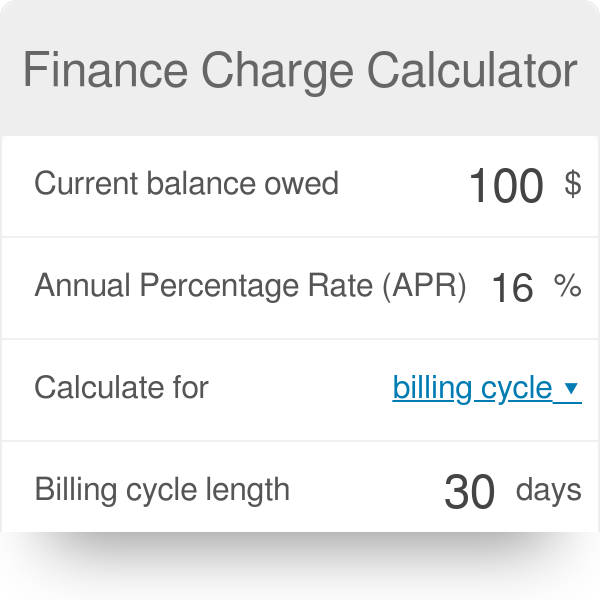

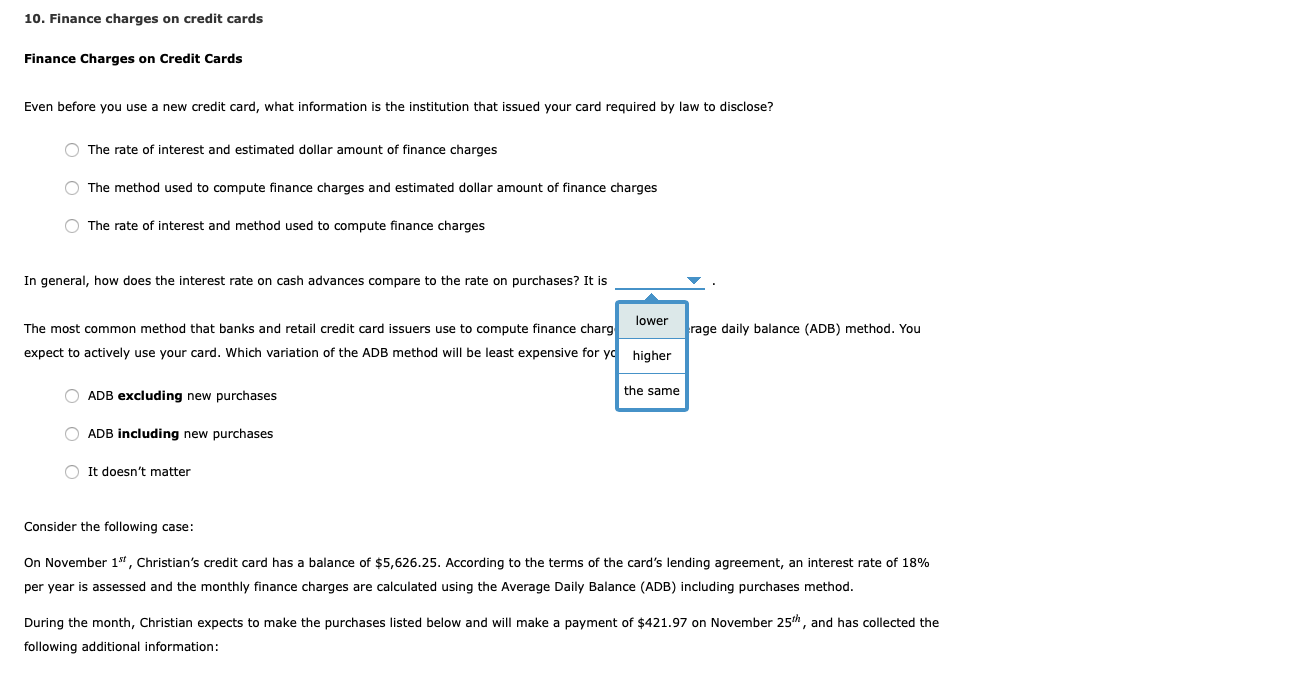

How to lower finance charges on credit cards. Yes, you can negotiate with your credit card company to reduce your interest. There are many ways to lower credit card costs: Moreover, your card issuer may levy a minimum finance charge.

Transfer balances to zero percent card. Negotiate with your credit card company. Find your apr on your credit card statement, then divide it by 365;

If you have good credit, you may qualify for an offer that allows you to transfer your balances to a card with a zero percent interest rate. Call up another card issuer and get an new account with lower rates. Interest free payments until 2024.

Ad credit cards maxed out? For example, if your finance charge for the month comes to $1.50, and the minimum charge is $5.00, then. Then have them transfer it all to your new card.

Compare low 0% intro apr, cash back & more today! A pair of bipartisan bills in congress aim to lower the swipe fees, also known as interchange fees, that retailers pay every time a customer makes a purchase with their card. You can avoid financing charges on nearly all credit cards, but the timing and amount of your credit card payment are all about that.

Pay off your cards in order of their interest rates. As long as you pay your full balance within the grace period each month (that. Ad get a card with 0% apr until 2024.

/Clipboard01-1cc7d1d55f684442b2aedef3f46ba5cc.jpg)

/pros-cons-personal-loans-vs-credit-cards-v1-4ae1318762804355a83094fcd43edb6a.png)

:max_bytes(150000):strip_icc()/dotdash-050214-credit-vs-debit-cards-which-better-v2-02f37e6f74944e5689f9aa7c1468b62b.jpg)